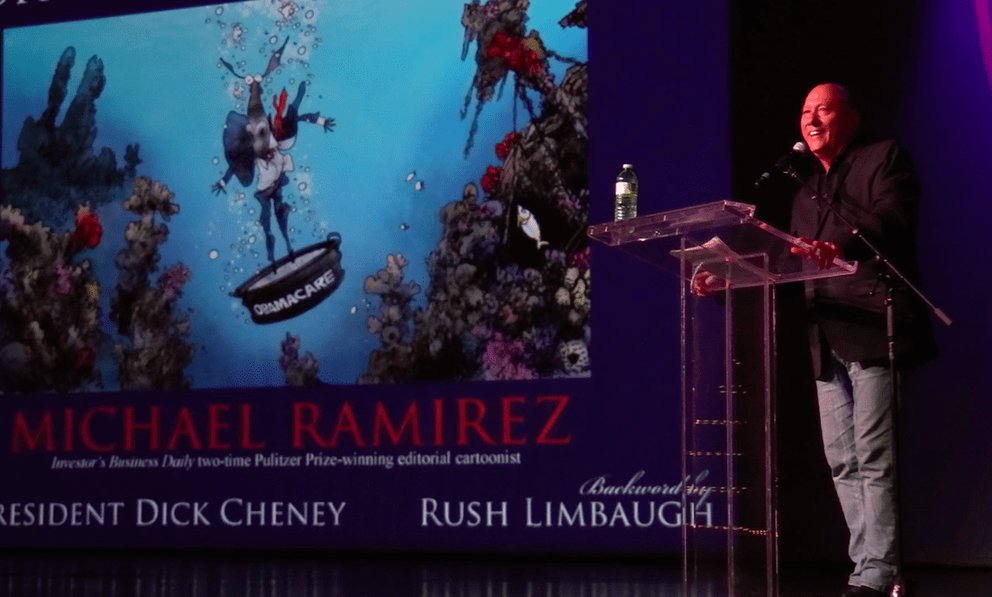

Welcome to the World of Pulitzer Prize Winning Political Cartoonist Michael P. Ramirez

No Trophies 03-03-17

For speaking requests, comments and questions, please email melissa@michaelpramirez.com

Although he travels frequently, Michael P. Ramirez works and lives near Los Angeles, California.

Although he travels frequently, Michael P. Ramirez works and lives near Los Angeles, California.

94,366,000 Americans Not in Labor Force as Participation Rate Ticks Up in January242,000 more Americans working part-time jobs this month than last

BY: Ali Meyer

February 3, 2017

WASHINGTON FREE BEACON

The number of Americans not participating in the labor force declined to 94,366,000 in January, according to the latest numbersreleased by the Bureau of Labor Statistics.

More Americans joined the labor force this month, leading to an uptick in the labor force participation rate and a decline in the number of Americans who are out of the labor force.

The number of Americans not in the labor force hit a record-high of 95,102,000 in December. This month, that number declined by 736,000 individuals.

The bureau counts those not in the labor force as people who do not have a job and did not actively seek one in the past four weeks.

The labor force participation rate, which is the percentage of the population that has a job or actively looked for one in the past month, increased from 62.7 percent in December to 62.9 percent in January.

While more joined the labor force this month, the number of unemployed individuals increased by 106,000 Americans, leading to an increase in the unemployment rate.

The unemployment rate for all Americans increased from 4.7 percent in December to 4.8 percent in January. This measure does not account for those individuals who have dropped out of the labor force and simply measures the percent of those who did not have a job but actively sought one over the month.

The "real" unemployment rate, otherwise known as the U-6 measure, was 9.4 percent in January, which increased from 9.2 percent in the previous month.

There were 5,840,000 Americans working part-time in January who would rather have a full-time job but cited economic reasons for not having such employment. This number increased by 242,000 over the month.

According to the bureau, involuntary part-time workers are "persons who indicated that they would like to work full time but were working part time (1 to 34 hours) because of an economic reason, such as their hours were cut back or they were unable to find full-time jobs."

"It looks like the optimism of the last two months is boosting the demand for workers," said Juanita Duggan, president and CEO of the National Federation of Independent Business. "That's a great thing for Americans looking for jobs and a strong sign that the U.S. economy is heating up."

"Fifteen percent of small business owners said that finding qualified workers was their single biggest problem," said Bill Dunkelberg, chief economist at the association. "That's an increase from the previous month and more proof that the labor market is getting tighter."

"In a tight labor market, business owners have to raise compensation to attract and retain the employees they need," he said. "The competition for qualified workers is getting more intense, and I would expect that in the next few quarters more firms will try to increase prices to cover the higher cost of labor."

BY: Ali Meyer

February 3, 2017

WASHINGTON FREE BEACON

The number of Americans not participating in the labor force declined to 94,366,000 in January, according to the latest numbersreleased by the Bureau of Labor Statistics.

More Americans joined the labor force this month, leading to an uptick in the labor force participation rate and a decline in the number of Americans who are out of the labor force.

The number of Americans not in the labor force hit a record-high of 95,102,000 in December. This month, that number declined by 736,000 individuals.

The bureau counts those not in the labor force as people who do not have a job and did not actively seek one in the past four weeks.

The labor force participation rate, which is the percentage of the population that has a job or actively looked for one in the past month, increased from 62.7 percent in December to 62.9 percent in January.

While more joined the labor force this month, the number of unemployed individuals increased by 106,000 Americans, leading to an increase in the unemployment rate.

The unemployment rate for all Americans increased from 4.7 percent in December to 4.8 percent in January. This measure does not account for those individuals who have dropped out of the labor force and simply measures the percent of those who did not have a job but actively sought one over the month.

The "real" unemployment rate, otherwise known as the U-6 measure, was 9.4 percent in January, which increased from 9.2 percent in the previous month.

There were 5,840,000 Americans working part-time in January who would rather have a full-time job but cited economic reasons for not having such employment. This number increased by 242,000 over the month.

According to the bureau, involuntary part-time workers are "persons who indicated that they would like to work full time but were working part time (1 to 34 hours) because of an economic reason, such as their hours were cut back or they were unable to find full-time jobs."

"It looks like the optimism of the last two months is boosting the demand for workers," said Juanita Duggan, president and CEO of the National Federation of Independent Business. "That's a great thing for Americans looking for jobs and a strong sign that the U.S. economy is heating up."

"Fifteen percent of small business owners said that finding qualified workers was their single biggest problem," said Bill Dunkelberg, chief economist at the association. "That's an increase from the previous month and more proof that the labor market is getting tighter."

"In a tight labor market, business owners have to raise compensation to attract and retain the employees they need," he said. "The competition for qualified workers is getting more intense, and I would expect that in the next few quarters more firms will try to increase prices to cover the higher cost of labor."

Critics of Trump Economic Plan Didn’t Point Out Obama Flaws

MAR 2, 2017

LAWRENCE KUDLOW THE INTELLIGENCER

Virtually the whole world is beating up on the Trump administration for daring to predict that low marginal tax rates, regulatory rollbacks and the repeal of Obamacare will generate 3 to 3.5 percent economic growth in the years ahead.

In a CNBC interview last week, Treasury Secretary Steven Mnuchin held the line on this forecast. He also argued the need for dynamic budget scoring to capture the effects of faster growth. Good for him.

But what’s so interesting about all the economic growth naysaying today is that former President Obama’s first budget forecast roughly eight years ago was much rosier than President Trump’s. And there was nary a peep of criticism from the mainstream media outlets and the consensus of economists.

Strategas Research Partners policy analyst Dan Clifton printed up a chart of the Obama plan that predicted real economic growth of roughly 3 percent in 2010, nearly 4 percent in 2011, over 4 percent in 2012 and nearly 4 percent in 2013.

But it turned out that actual growth ran below 2 percent during this period. Was there any howling about this result among the economic consensus? Of course not. It seems it has saved all its grumbling for the Trump forecast.

And what’s really interesting is that the Obama policy didn’t include a single economic growth incentive. Not one. Instead, there was a massive $850 billion so-called spending stimulus (Whatever became of those spending multipliers?), a bunch of public works programs that never got off the ground and, finally, Obamacare, which really was one giant tax increase.

Remember when Supreme Court Chief Justice John Roberts ruled that the health-care mandate was in fact a tax? But it wasn’t just a tax. It was a tax hike. And added to that were a 3.8 percent investment tax hike, a proposed tax hike on so-called Cadillac insurance plans and yet another tax increase on medical equipment.

So eight years ago, tax-and-spend was perfectly OK. And the projection that it would produce a 4 percent growth rate perfectly satisfied the economic consensus.

Make sense? No, it does not.

So here’s President Trump reaching back through history for a common-sense growth policy that worked in the 1960s, when President John F. Kennedy slashed marginal tax rates on individuals and corporations, and again in the 1980s, when President Ronald Reagan slashed tax rates across the board and sparked a two-decade boom of roughly 4 percent real annual growth

But the economic consensus won’t buy Trump’s plan.

One after another, Trump critics argue that because we’ve had 2 percent growth over the past 10 years or so, we are doomed to continue that forever. This is nonsense.

Most of them point to the decline in productivity over the past 15 years. They say that unless productivity jumps to 2.5 percent or so, and unless labor-force participation rises, we can’t have 3 to 4 percent growth.

Stanford University economics professor John Taylor, who’s also a research fellow at the Hoover Institution, is one of the nation’s top academic economists. He released a chart on productivity growth that shows that productivity declines can be followed by productivity increases, which unfortunately can be followed again by productivity declines.

In his widely read blog, Economics One, Taylor wrote one post titled “Take Off the Muzzle and the Economy Will Roar.” He notes that bad economic policy leads to slumping productivity, living standards, real wages and growth.

We can see “huge swings in productivity growth in recent years,” he says. “These movements … are closely related to shifts in economic policy, and economic theory indicates that the relationship is causal.”

He concludes, “To turn the economy around we need to take the muzzle off, and that means regulatory reform, tax reform, budget reform, and monetary reform.” Well, aren’t those exactly the reforms that President Trump is promoting?

Get rid of the state-sponsored barriers to growth. Then watch how these common-sense incentive-minded policies turn a rosy scenario into economic reality.

MAR 2, 2017

LAWRENCE KUDLOW THE INTELLIGENCER

Virtually the whole world is beating up on the Trump administration for daring to predict that low marginal tax rates, regulatory rollbacks and the repeal of Obamacare will generate 3 to 3.5 percent economic growth in the years ahead.

In a CNBC interview last week, Treasury Secretary Steven Mnuchin held the line on this forecast. He also argued the need for dynamic budget scoring to capture the effects of faster growth. Good for him.

But what’s so interesting about all the economic growth naysaying today is that former President Obama’s first budget forecast roughly eight years ago was much rosier than President Trump’s. And there was nary a peep of criticism from the mainstream media outlets and the consensus of economists.

Strategas Research Partners policy analyst Dan Clifton printed up a chart of the Obama plan that predicted real economic growth of roughly 3 percent in 2010, nearly 4 percent in 2011, over 4 percent in 2012 and nearly 4 percent in 2013.

But it turned out that actual growth ran below 2 percent during this period. Was there any howling about this result among the economic consensus? Of course not. It seems it has saved all its grumbling for the Trump forecast.

And what’s really interesting is that the Obama policy didn’t include a single economic growth incentive. Not one. Instead, there was a massive $850 billion so-called spending stimulus (Whatever became of those spending multipliers?), a bunch of public works programs that never got off the ground and, finally, Obamacare, which really was one giant tax increase.

Remember when Supreme Court Chief Justice John Roberts ruled that the health-care mandate was in fact a tax? But it wasn’t just a tax. It was a tax hike. And added to that were a 3.8 percent investment tax hike, a proposed tax hike on so-called Cadillac insurance plans and yet another tax increase on medical equipment.

So eight years ago, tax-and-spend was perfectly OK. And the projection that it would produce a 4 percent growth rate perfectly satisfied the economic consensus.

Make sense? No, it does not.

So here’s President Trump reaching back through history for a common-sense growth policy that worked in the 1960s, when President John F. Kennedy slashed marginal tax rates on individuals and corporations, and again in the 1980s, when President Ronald Reagan slashed tax rates across the board and sparked a two-decade boom of roughly 4 percent real annual growth

But the economic consensus won’t buy Trump’s plan.

One after another, Trump critics argue that because we’ve had 2 percent growth over the past 10 years or so, we are doomed to continue that forever. This is nonsense.

Most of them point to the decline in productivity over the past 15 years. They say that unless productivity jumps to 2.5 percent or so, and unless labor-force participation rises, we can’t have 3 to 4 percent growth.

Stanford University economics professor John Taylor, who’s also a research fellow at the Hoover Institution, is one of the nation’s top academic economists. He released a chart on productivity growth that shows that productivity declines can be followed by productivity increases, which unfortunately can be followed again by productivity declines.

In his widely read blog, Economics One, Taylor wrote one post titled “Take Off the Muzzle and the Economy Will Roar.” He notes that bad economic policy leads to slumping productivity, living standards, real wages and growth.

We can see “huge swings in productivity growth in recent years,” he says. “These movements … are closely related to shifts in economic policy, and economic theory indicates that the relationship is causal.”

He concludes, “To turn the economy around we need to take the muzzle off, and that means regulatory reform, tax reform, budget reform, and monetary reform.” Well, aren’t those exactly the reforms that President Trump is promoting?

Get rid of the state-sponsored barriers to growth. Then watch how these common-sense incentive-minded policies turn a rosy scenario into economic reality.