Welcome to the World of Pulitzer Prize Winning Political Cartoonist Michael P. Ramirez

Cockpit Politics 02-20-17

104 Billion Reasons to Confront Obamacare's Hidden Spending

FEB 17, 2017 | By JEFFREY H. ANDERSON

With Obamacare unraveling in almost all ways, it's time to unravel the phony accounting practices that have allowed it to hide some $104 billion in federal spending. Under Obamacare, this money has been paid directly to insurance companies as outlays, yet it has gone into the books as "tax cuts." To put $104 billion into perspective, that's about as much as the Apollo program cost (in today's dollars) from its inception until it succeeded in putting a man on the moon. If only someone had thought of a way to score Apollo as a "tax cut."

As I have previously noted, when Obamacare is not dumping people into Medicaid, it functions by having the federal government send billions of dollars in direct payments to insurance companies. Taxpayers pay this money to the federal government, and the government then pays it to insurers. By any normal definition of terms, the money coming in constitutes revenues, and the money going out constitutes outlays.

Under Obamacare, however, these direct subsidies to insurance companies are labeled as "tax credits." To the degree that those who ultimately benefit from these subsidies actually pay income taxes, these "tax credits" are then scored as "tax cuts." In this manner, Obamacare is masking some $104 billion in federal spending over a decade (the rough portion of Obamacare's direct payments to insurers that the Congressional Budget Office is counting as tax cuts (see table 2)).

The Government Accountability Office defines a "tax credit" as an "amount that offsets or reduces tax liability." But Obamacare's payments to insurers don't offset or reduce anyone's taxes. The GAO also says a tax credit is a "tax expenditure," and it defines the workings of a tax expenditure as follows: "Rather than transferring funds from the government to the private sector, the U.S. government forgoes some of the receipts that it would have collected, and the beneficiary taxpayers pay lower taxes than they would have had to pay." But when an insurer receives a direct subsidy under Obamacare, the government does transfer funds to the private sector, it doesn't forgo receipts it would have collected, and the "beneficiary taxpayers" don't pay lower taxes than they would have had to pay. read more at the Weekly Standard

FEB 17, 2017 | By JEFFREY H. ANDERSON

With Obamacare unraveling in almost all ways, it's time to unravel the phony accounting practices that have allowed it to hide some $104 billion in federal spending. Under Obamacare, this money has been paid directly to insurance companies as outlays, yet it has gone into the books as "tax cuts." To put $104 billion into perspective, that's about as much as the Apollo program cost (in today's dollars) from its inception until it succeeded in putting a man on the moon. If only someone had thought of a way to score Apollo as a "tax cut."

As I have previously noted, when Obamacare is not dumping people into Medicaid, it functions by having the federal government send billions of dollars in direct payments to insurance companies. Taxpayers pay this money to the federal government, and the government then pays it to insurers. By any normal definition of terms, the money coming in constitutes revenues, and the money going out constitutes outlays.

Under Obamacare, however, these direct subsidies to insurance companies are labeled as "tax credits." To the degree that those who ultimately benefit from these subsidies actually pay income taxes, these "tax credits" are then scored as "tax cuts." In this manner, Obamacare is masking some $104 billion in federal spending over a decade (the rough portion of Obamacare's direct payments to insurers that the Congressional Budget Office is counting as tax cuts (see table 2)).

The Government Accountability Office defines a "tax credit" as an "amount that offsets or reduces tax liability." But Obamacare's payments to insurers don't offset or reduce anyone's taxes. The GAO also says a tax credit is a "tax expenditure," and it defines the workings of a tax expenditure as follows: "Rather than transferring funds from the government to the private sector, the U.S. government forgoes some of the receipts that it would have collected, and the beneficiary taxpayers pay lower taxes than they would have had to pay." But when an insurer receives a direct subsidy under Obamacare, the government does transfer funds to the private sector, it doesn't forgo receipts it would have collected, and the "beneficiary taxpayers" don't pay lower taxes than they would have had to pay. read more at the Weekly Standard

Commentary from our good friend, John Hinderaker at POWERLINE:

FEBRUARY 21, 2017

THE OBAMACARE MESS: IT’S ALL THE GOP’S

Donald Trump said in a recent press conference that he had inherited a mess when he became president. This prompted the usual howls of outrage from the liberal press, but I think it is fair to say that every president inherits a mess. It goes with the job.

In at least one respect, however, Trump inherited not just a mess, but a steaming pile of dung. In other words, Obamacare. Obamacare and its state variants are in a death spiral. Everyone agrees that something needs to be done, but that “something” will have to get past a Democratic filibuster in the Senate. Time will tell what emerges from the wreckage of Obamacare, but in the meantime, Michael Ramirez sums up superbly the situation in which Republicans find themselves

FEBRUARY 21, 2017

THE OBAMACARE MESS: IT’S ALL THE GOP’S

Donald Trump said in a recent press conference that he had inherited a mess when he became president. This prompted the usual howls of outrage from the liberal press, but I think it is fair to say that every president inherits a mess. It goes with the job.

In at least one respect, however, Trump inherited not just a mess, but a steaming pile of dung. In other words, Obamacare. Obamacare and its state variants are in a death spiral. Everyone agrees that something needs to be done, but that “something” will have to get past a Democratic filibuster in the Senate. Time will tell what emerges from the wreckage of Obamacare, but in the meantime, Michael Ramirez sums up superbly the situation in which Republicans find themselves

Michael's books - Click to purchase from Amazon

Dumbest Ever Defense of Obamacare

The arguments of PPACA’s apologists transcend the farcical.

David Catron, February 20, 2017, THE SPECTATOR

Rational observers of Obamacare’s accelerating implosion will be drawn inexorably toward the conclusion that it is, as Aetna chief executive Mark Bertolini put it last week, “in a death spiral.” However, as our friends on the left have clearly demonstrated since November, they are anything but rational. Thus, they continue to delude themselves that “reform” will somehow survive the laws of economics as well as the ire of the electorate. This fantasy has led to all manner of absurd claims about the law’s alleged accomplishments. The latest miracle they have attributed to Obamacare is a decline in the divorce rate.

Yes, you read that correctly. A couple of academics from the University of Kansas analyzed the impact of the law on divorce rates, and you won’t be surprised to learn that their “research” produced results“strongly suggesting that it reduced medical divorce” in states that complied with Obamacare’s Medicaid expansion. They found that “expansion decreased the prevalence of divorce by 5.6% among those 50-64,” compared to states that didn’t comply. Are these data credible? Apparently not. Even the study’s author admitted to Fortune, “Overall, it’s tough to find valid statistics on medical divorce specifically.” more below

The arguments of PPACA’s apologists transcend the farcical.

David Catron, February 20, 2017, THE SPECTATOR

Rational observers of Obamacare’s accelerating implosion will be drawn inexorably toward the conclusion that it is, as Aetna chief executive Mark Bertolini put it last week, “in a death spiral.” However, as our friends on the left have clearly demonstrated since November, they are anything but rational. Thus, they continue to delude themselves that “reform” will somehow survive the laws of economics as well as the ire of the electorate. This fantasy has led to all manner of absurd claims about the law’s alleged accomplishments. The latest miracle they have attributed to Obamacare is a decline in the divorce rate.

Yes, you read that correctly. A couple of academics from the University of Kansas analyzed the impact of the law on divorce rates, and you won’t be surprised to learn that their “research” produced results“strongly suggesting that it reduced medical divorce” in states that complied with Obamacare’s Medicaid expansion. They found that “expansion decreased the prevalence of divorce by 5.6% among those 50-64,” compared to states that didn’t comply. Are these data credible? Apparently not. Even the study’s author admitted to Fortune, “Overall, it’s tough to find valid statistics on medical divorce specifically.” more below

It’s far less difficult to determine what is driving such “research” or the disproportionate amount of coverage it gets in the media. Obamacare’s apologists are desperately casting about for some reason to justify its existence, and this has not been easy in recent weeks. Since the beginning of the year, all the legitimate news about the law has been bad. The year began with Congress taking its first procedural steptoward repeal, President Trump’s executive order instructing all relevant executive branch agencies to slow walk implementation of Obamacare, and the cancelation of $5 million in Healthcare.gov ads.

But February has been the cruelest month of all for the moribund health care law. The month began with the announcement that Healthcare.gov signups for 2017 lagged far behind Obama administration projections. After the White House and congressional Democrats had repeatedly claimed that enrollment was skyrocketing to record highs due to public apprehension concerning President-elect Trump’s plans to repeal the “Affordable Care Act,” the actual figures fell short of last year’s totals. With typical chutzpah, congressional Democrats and the “news” media blamed the shortfall on President Trump.

The next blow fell about a week following the announcement of Obamacare’s anemic enrollment totals. After a couple of confirmation hearings during which the Democrats attempted to portray him as the Bernie Madoff of health care, the Senate confirmed Rep. Tom Price — a longtime advocate of Obamacare repeal — as Secretary of Health and Human Services (HHS). Secretary Price is perfect for the job, having practiced medicine for 20 years before he entered politics and enjoying nearly universal respect among health care policy experts of all political stripes. In other words, he is Obamacare’s worst nightmare.

more below

But February has been the cruelest month of all for the moribund health care law. The month began with the announcement that Healthcare.gov signups for 2017 lagged far behind Obama administration projections. After the White House and congressional Democrats had repeatedly claimed that enrollment was skyrocketing to record highs due to public apprehension concerning President-elect Trump’s plans to repeal the “Affordable Care Act,” the actual figures fell short of last year’s totals. With typical chutzpah, congressional Democrats and the “news” media blamed the shortfall on President Trump.

The next blow fell about a week following the announcement of Obamacare’s anemic enrollment totals. After a couple of confirmation hearings during which the Democrats attempted to portray him as the Bernie Madoff of health care, the Senate confirmed Rep. Tom Price — a longtime advocate of Obamacare repeal — as Secretary of Health and Human Services (HHS). Secretary Price is perfect for the job, having practiced medicine for 20 years before he entered politics and enjoying nearly universal respect among health care policy experts of all political stripes. In other words, he is Obamacare’s worst nightmare.

more below

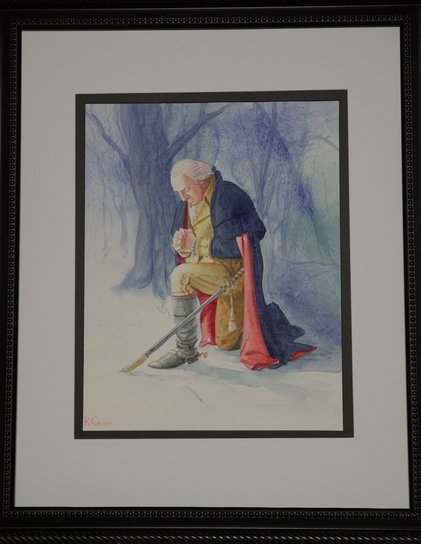

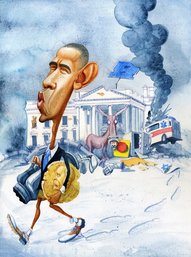

Our good friend Roman Genn is one of our favorite fine artists and he has created a limited print of his brilliant watercolor seen on the Jan. 23rd issue of the National Review magazine. It's called Outta Here, and is limited to only 100 signed and numbered fine giclee prints. It is conveniently sized at 12 x 16, with the image measuring 9 x 12 inches. We love the fact that Roman immigrated to the United States in 1991 after a storied career in Moscow as a teenaged political activist who used his art to protest the Soviet system. Read more about Roman HERE. Click here or on Image to purchase (may take a few minutes to load). For George Washington's birthday, and for American's everywhere, Roman's cover portrait of General Washington in the woods of Valley Forge is signed and numbered in a limited grouping that is beginning to run low. Available by clicking on image. |

The first HHS rule issued under Price’s leadership is designed to stabilize the chaotic, politically driven management of Obamacare’s enrollment periods and guaranteed availability that prevailed under his recent predecessors. It also permits insurers to ask individuals for previously unpaid premiums before enrolling them in new coverage, a change meant to put a halt to the widespread gaming of the law’s 90-day grace period provision to which the Obama administration turned a blind eye. Naturally, Obamacare pimps have denounced the new rule as a ploy “to increase the hassle of obtaining coverage.”

While these people were still reeling from the alacrity with which Price addressed PPACA’s chronic enrollment chaos, they were hit with what one has styled the “IRS stealth attack on Obamacare.” This outrage consists of a revised rule whereby the agency will continue to process tax returns that fail to state whether the filer had health coverage during the tax year. The IRS will thus treat the returns just as it has for the past two years, but Obamacare apologists complain that it will neuter the individual mandate. It’s hard to see this as a tragedy, but it’s a good bet that a lot of taxpayers will leave line 61 blank on their 1040s. Read more at The Spectator

While these people were still reeling from the alacrity with which Price addressed PPACA’s chronic enrollment chaos, they were hit with what one has styled the “IRS stealth attack on Obamacare.” This outrage consists of a revised rule whereby the agency will continue to process tax returns that fail to state whether the filer had health coverage during the tax year. The IRS will thus treat the returns just as it has for the past two years, but Obamacare apologists complain that it will neuter the individual mandate. It’s hard to see this as a tragedy, but it’s a good bet that a lot of taxpayers will leave line 61 blank on their 1040s. Read more at The Spectator